What’s caught my eye …

The Syrian government scrapes the bottom of the barrel, relying on ransoms paid for family members kidnapped inside Syria by Assad security forces:

Syrian Detainees’ Families Forced to Pay Huge Bribes to Corrupt Officials – Report (Guardian)

Ahmad is one former prisoner who thought he would never see his family again. He was detained in nine different prisons in three years and his family paid $30,000 in bribes to get him out.“Like many families, mine kept paying $1,000 here and $1,000 there, hoping they were giving it to a person who could get them information,” he said. “Eventually they paid a large sum to a lawyer who told them that some of it will go to a judge and some to the security forces.”

The Syrian war has been running down for awhile. Last year’s Assad/Russia offensive to retake Idlib has been shelved, air strikes to soften up jihadi positions have been limited, Turkish activity in the north to sporadic shelling of Kurdish positions. Obviously, coronavirus is a factor; the bigger problem for participants is shortage of cash and/or outright bankruptcy, including Iran, Russia and Turkey. It’s meaningful Damascus has stooped to robbing its citizens in the street (in a manner of speaking) to fund itself, it means there is nothing left to work with, that its economy is dead.

Possible/hopefully, the current pause will result in a settlement that ends the fighting permanently and allows Syrians to return home. A difficulty is arriving at a settlement that leaves bloody-handed Assad in charge, even nominally, or that cedes Syrian territory to Turkey.

The Covid Bankruptcies: Guitar Center to Youfit (Bloomberg)

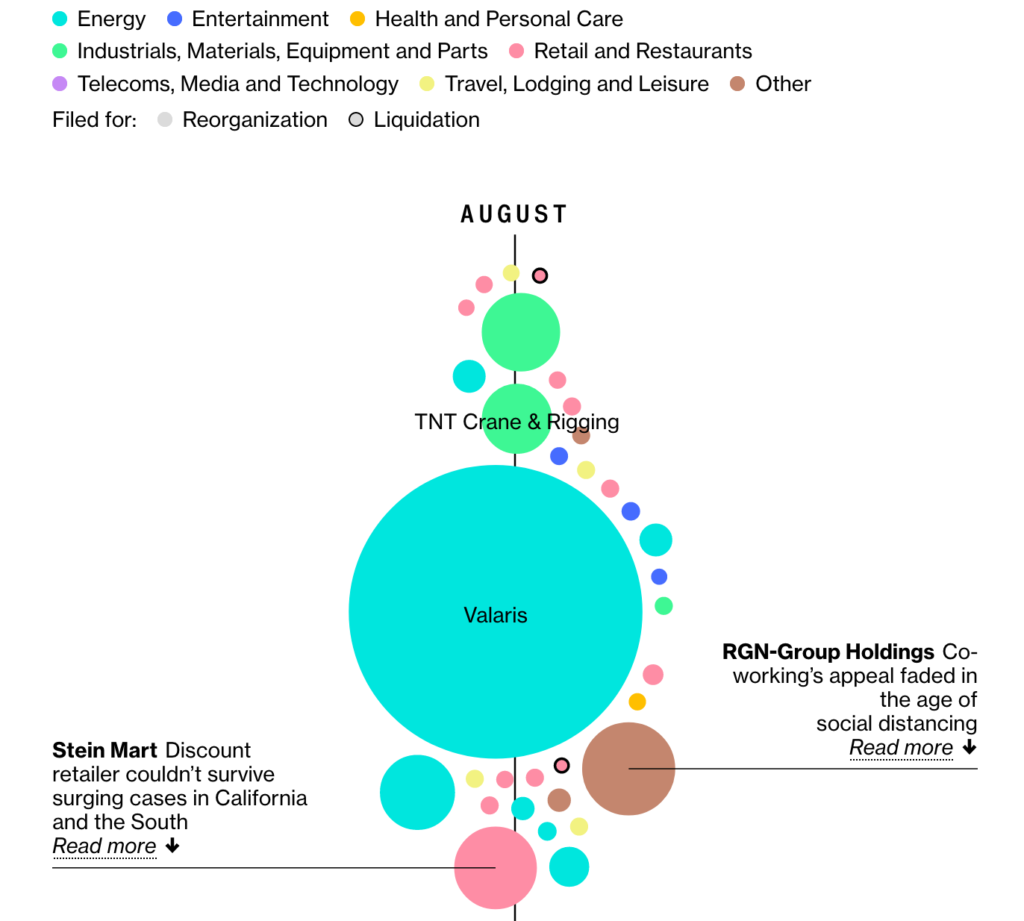

Figure 1: August was the cruelest month … except for all the others. Valaris is an offshore drilling company (Bloomberg)

Retailers, airlines, restaurants. But also oil producers, mall landlords, and gyms across the country. These are some of the more than 340 companies that declared bankruptcy in the U.S. in 2020 and blamed Covid-19 in part for their demise.

Blame it on governors not sensible individuals who finally put ‘shop ’til you drop’ into perspective.

Many were in deep financial trouble even before governors ordered non-essential businesses shut to help contain the spread of the virus. Some, like opioid-maker Mallinckrodt and a number of Catholic dioceses, filed primarily to get relief from huge lawsuit liabilities but also said the pandemic contributed to their financial woes.

Of the hundreds of US firms that fell into bankruptcy last year the hammer fell hard on the petroleum sector. Like Syrian refugees, American customers are straitened. Work-from-home and cancelled events meant less driving, flying and sharply reduced fuel consumption which tipped vulnerable E&P and oilfield services companies over the edge. Meanwhile, retailers struggled with long-term structural issues; oversupply of shopping space generally, iffy service and mediocre products along with the shift to online shopping where crappy products can be had with less hassle.

Sadly, nobody has figured out how to ‘de-broke’ the customers. The shortage of bottom-up demand has been harsh for a system built around the steady increase of mindless consumption. Governments are casting about, frantic for ways to gin up animal spirits. Enter the OECD economist demanding more fiscal spending without explaining what the spending will accomplish … other than hastening the destruction of our planetary life support system:

OECD Warns Governments to Rethink Constraints on Public Spending (FT)

Laurence Boone, who has run the economics directorate at the Paris-based organisation since 2018, told the Financial Times that the public would revolt against renewed austerity or tax rises if governments sought to quickly return deficits and debt to pre-pandemic levels.Governments and central banks across the developed world have rolled out unprecedented stimulus measures in a bid to cushion their economies from the massive impact of the pandemic. After the crisis “people are going to ask where all this money has come from,” Ms Boone said, adding that governments would struggle to argue they could not spend to address climate change or to compensate those who lose out from policy reforms.

“If we thought there was popular resentment because the quality of jobs was going down [before Covid-19], then it’s going to be much worse after this pandemic,” she said.

The problem is there is no organized or coherent strategy to deal with our unbalanced and careening economic regime. The approach is one bandage to the next, one improvised bailout after another. Nobody asks whether the regime itself is sub-optimal or worth rescuing. OECD demands governments take over from central banks, to swap fiscal- for monetary policy, but there is no clear demarcation lines between central banks and governments. Both are intertwined servants of Big Business, unhappy tycoons and the interests that have grown up around them. And while governments cannot in theory go bankrupt, they can do a good job of faking it.

$2,000 Stimulus Checks Are Poorly Targeted and That’s Fine (New York)

Unless one believes that the U.S. is on the brink of runaway inflation, this development seems unambiguously good! When compared with an alternative of “nothing,” adding a half-trillion dollars to U.S. households’ bank accounts actually furthers the very objectives that Rampell and Summers wish to prioritize: providing Americans with more disposable income will surely produce more consumer spending, and thus, more sales-tax revenue for state and local governments to collect, and more job opportunities for the unemployed.

That’s the divide, between spend now and scrimp later; between Larry Summers and the OECD, between Post-Keynesians and Austerians; between two or groups of the blind and over-committed. It is reasonable that the government should spare the public from the consequences of the governments’ own failures and mismanagement. At the same time, neither governments nor central banks can ‘gin up’ or print solvency or value, nor can they put resources into the ground. What’s missing is purchasing power, in the way of human ability to direct work to access resources. That’s gone and not coming back.