By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News, January 18, 2022

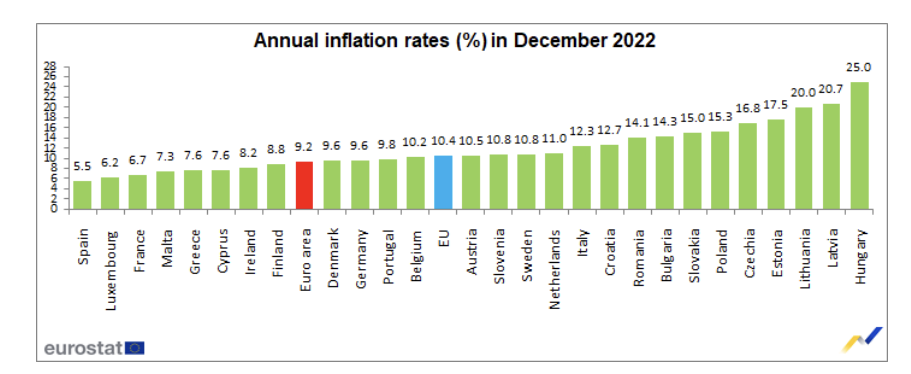

The euro area annual inflation rate was 9.2% in December 2022, down from 10.1% in November. A year earlier, the rate was 5.0%.

European Union annual inflation was 10.4% in December 2022, down from 11.1% in November. A year earlier, the rate was 5.3%. These figures were published today by Eurostat, the statistical office of the European Union.

The lowest annual rates were registered in Spain (5.5%), Luxembourg (6.2%) and France (6.7%).

The highest annual rates were recorded in Hungary (25.0%), Latvia (20.7%) and Lithuania (20.0%).

Compared with November, annual inflation fell in twenty-two Member States, remained stable in two and rose in three.

In December, the highest contribution to the annual euro area inflation rate came from food, alcohol & tobacco (+2.88 percentage points, pp), followed by energy (+2.79 pp), services (+1.83 pp) and non-energy industrial goods (+1.70 pp).

Read also : How to invest in gold

The European statistics agency Eurostat earlier reported that the inflation rate in the euro zone in November was 10.1%, after it reached a record in October at 10.6% in annual terms, after 10% in September and 9.1% in August.

Up to 31 December 2022, the euro area included Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland. From January 2023 the euro area also includes Croatia.

The European Union includes Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland and Sweden.

The social pact of European democracies is disintegrating before our eyes. More and more citizens are questioning the legal authority and legitimacy of European governments, their policies and the capitalist model. A short-term solution is to support modest families and those of the middle class, in order to avoid their financial bankruptcy. Next must come major economic and fiscal reform in the euro zone, whose 19 member states have the same currency but 19 different economies, 19 different budgets and 19 different tax systems.

Thousands of protesting citizens are in the streets today in France, protesting against inflation and the French President Emmanuel Macron’s controversial pension reform. French unions have called for strikes. The French should work two years longer before they can retire, said the unpopular Prime Minister Elisabeth Borne.

Another priority is to start a serious thinking on the purchasing power of money in Europe. Should the gold standard be restored to strengthen the euro? Why not ? The central banks of emerging countries move away each month a little more from the dollar and accumulate gold.

Thank you for being among our readers.

Our community already has nearly 95,000 members.

Sign up to get our exclusive articles.

To receive premium content, subscribe, it’s only €8.99/month. You will see the subscription form on posts with restricted access.

Support us by sharing our publications!

© Copyright 2022 – Swann Collins, investor, writer and consultant in international affairs.

Source link