“Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally”

— Keynes

The rumors of its death might be premature but who knows? There are more economists than at any time in history but at the same time fewer who appear relevant. Economists have become today’s version of post-dispatch riders. A large part of the appeal is quaintness, the clubby leather-bound nostalgia. Is there anything else to it? Economics finds itself caught up in an existential crisis presided over by economists. Tending to the onrushing collapse of our planetary life support system, the annihilation of a large part of it and perhaps us … is not something that can be put on a resumé. On the broadest possible scope the discipline has failed almost beyond the bounds of failure. Consider a politician in charge of an all-out thermonuclear war, this would be both a black mark and something to avoid one would think.

Nevertheless, the economic space is filled with salesmen, bent toward convention so they will never be blamed, black gangs of Stakhanovite shovelers toiling in the boiler rooms of finance feeding the furnaces with moral hazard. ‘Others’ — whose sensitivities are not aligned with those if the establishment — need not apply.

What America teaches us is anything and everything can be degraded. Why not economics? Our European forebears inherited a civilization, it was blown to pieces in the early twentieth century. Americans cobbled together entertainments and distractions out of the post-European wreckage, economics advanced to rationalize the process. That’s when the dumbing down began. Now, the entire distraction-industrial enterprise is falling apart under its own weight. Economics can’t cope. The discipline lacks common reference points other then a by-now tiresome demand for more growth. This demand is made regardless of quality or outcome or even its possibility. What economists can’t- or won’t answer is ‘what’s the point?’

An interview with ex-Treasury Secretary Larry Summers in a recent Time Magazine article:

Summers is having his emeritus star turn, giving hope to millions of white male suburban economists languishing in cul-de-sacs everywhere across The (not so) Free World. “If Summers can do it,” exclaim the other over-the-hill economists, “So can I!”

When a former Democratic Secretary of the U.S. Treasury raises alarm bells about the potential harmful consequences of the current President’s economic policies, it raises home-team hackles. Larry Summers, who served as Treasury Secretary under Bill Clinton and director of the National Economic Council under President Obama, has emerged as a leading cautionary voice about how heavy government spending can trigger damaging levels of inflation. The crux of his worry is a pronounced lack of faith in the Federal Reserve’s ability to bring an overheated economy under control by raising interest rates without a costly recession.Inflation worries are broadly rising. Last month, the Labor Department reported its Consumer Price Index jumped 4.2% in April from a year earlier. The core price index, which excludes the volatile categories of energy and food, increased 3% in April from a year before.

There are signs the economy is heating up—the stock market is booming, the housing market is surging and a range of companies are reporting very strong results. Yet almost 10 million Americans are unemployed (unemployment is 5.8%) and there were still nearly 8 million fewer jobs in May than pre-pandemic levels. The Biden Administration is betting that these pressures are temporary,

Is economics really dead or is it just resting?

TIME: What was your reaction to President Biden’s $6 trillion budget proposal?

LARRY SUMMERS:

There’s no question that we need substantial increases in public investment, substantially more attention to sustainability and preserving the planet, substantially more focus on the needs of children, particularly children from lower-income and middle-class families. And that we need to take better care of our seniors. And so I think President Biden’s judgment, that this is the moment for a large-scale increase in public investment, is correct.

ECONOMIC UNDERTOW:

It’s inadequate in both content and form. There are no structural changes, the time horizon is too short. If Biden was serious he would cut military spending in half which is not happening. Instead, the government is feeding the sacred cows, throwing borrowed money in the general direction of problems and hoping something positive trickles down. Meanwhile, most if not all of that spending benefits finance and tycoons who are first in line for credit. Those at the bottom of the food chain get crumbs, just enough to keep them able to service and retire the tycoons’ debts.

The theme is for government to shift as many of its duties as possible to the private sector, paying minimal attention to conditions as they develop on the ground. The government is at the same time a silent partner to these private interests. As a particular scenario unfolds it becomes clear the extent of loss is due to a combination of government negligence and private sector failure. Afterward, the government throws a little more money around to pacify the citizens and limit liability of the private sector partners.

This laissez-faire theme is the structural defect: government disregard, private sector diffidence, the predictable calamity then the bailout of special interests. Some activity is ongoing like the continued multi-decade bailout of auto- and highway interests and military bloat. Biden’s budget is part of the piece.

Government negligence both prior to- and after the emergence of Covid was blatant and obvious, what is little reckoned was the absolute failure of the private sector medical service industry when confronted with Covid. The US has the most expensive, highly technical health service provision on Planet Earth and this industry had absolutely nothing to offer. It was completely passive. There was no leadership, no alerts, no outreach, no strategies to control virus outbreak, no preparation before hand, only passing the buck to the CDC and FDA, begging for basic supplies which they should have had in adequate supply. This from the same cartel that has relentlessly ‘optimized’ in the pursuit of money returns; buying and closing hospitals, cutting staffs, eliminating hospital beds, pressuring employee salaries, ignoring preventive care. Executive payouts are gigantic even as hospitals pursue collections against their own clients through the courts. Elsewhere, the transport and leisure industries with almost purposeful carelessness enabled the explosion of cases from a handful in one country to millions around the world in a matter of weeks.

Fast forward one year, a half-million Americans are dead, disruption is general, small business has been gutted; comes now the bailout of various pet industries such as airlines, real estate, finance and billionaires generally.

TIME: What do you think the biggest threat facing the economy is right now?

LARRY SUMMERS:

The long-run threat is that we will cease to be one effective country. Whether that’s a failure of public investment in everything ranging from collecting the taxes that are owed—where there will be $7 trillion in taxes that are owed but not paid over the next decade; that is a huge loss to the government … [and] a huge source of injustice because most of the nonpayment comes among the highest-income Americans. Whether it is the fact that at the early stage, we were dependent on other countries for masks, and we were not well prepared for a pandemic, despite the fact that there had been repeated warnings that a next pandemic would come.

ECONOMIC UNDERTOW:

The first impulse is to say ‘rampant fraud’ but that does not go deep enough: cowardice. Americans have become unwilling to face the world as it is and do something about it. We have become comfortable, our passivity feeds on itself. Meanwhile, our economy has long since failed meet its promises, morphing under our noses into a grab bag of control frauds, Ponzi schemes and get-rich-quick rackets, shakedowns and scams. The world is strip-mined, what is there to show for it? People can watch videos of a celebrity driving an electric car. Some tycoon or other on Pedophile island gets a tax credit. Who cares? The medieval serf at least had the illusion- the gambler’s chance at paradise in the Great Beyond. What’s in it for us? A toilet. Voyeurism. Heroin. Totalitarianism, hard-nosed business and political ‘realpolitik’, pop culture decadence; all of it entirely trivial, banal, ugly, dispiriting, empty of any meaningful values and anti-human. Plenty of free parking.

What comes next? Nobody knows. Oh, your grandchildren won’t have enough to eat. Well, that’s too damned bad! Here’s a stimulus check to shut you up! Folks in charge lack the imagination to consider anything other than reflexive doubling down on the status quo. It isn’t so much the failed utopian promises but the delivery of excess real costs, or costs that are felt immediately rather than in some distant future: what Herman Daly refers to as uneconomic growth. The establishment, whose duty is to be mindful of such things, is adrift. Industrial modernity has an operating system that has corrupted itself leaving billions at risk whether the machine works or fails. We don’t know how to turn the damned thing off or how to fix it without risking damage to ourselves and our precious prejudices. Not only do we lack perspective but we lack the tools to even grasp what it is we don’t understand. The outcome is frenzied repetition of destructive activities for negative return on one hand and dithering, feckless management that is devastatingly irrelevant. Economists and other elites waving their hands, intoning ” … sustainability and preserving the planet, substantially more focus on the needs of children, particularly children from lower-income and middle-class families.”

TIME: And does the new budget address that?

LARRY SUMMERS:

I think that’s what the President’s program is trying to address in many powerful ways. I do think that it is also important, and it is important for the sustainability of the progressive enterprise, that it be managed in a macroeconomically prudent way. And I am concerned that we are injecting more demand into the economy than the potential supply of the economy is likely to work out to be. And that will generate overheating.

ECONOMIC UNDERTOW:

No. What’s needed are structural changes not just a money dump.

TIME: What about the argument from within the Administration that these are blips causing the inflation?

LARRY SUMMERS:

There are transitory factors that go in both directions. Housing has been a sector that in the price indices is holding the inflation statistic way down. But in reality, Americans are experiencing maybe the fastest housing price inflation ever. For the first time ever, a majority of houses are selling above their asking price … I see housing as a potential source of accelerating inflation. Usually, the idea is that as demand picks up relative to supply, inflation tends to accelerate. People are looking in a serious way at a quarterly growth rate for the second quarter that might exceed 10%; as that plays through the system, there are likely to be more bottlenecks and more shortages.

ECONOMIC UNDERTOW:

The narrative is excess central bank credit causes inflation which is bad, excess government spending causes inflation which is also bad. Central banks are collateral constrained and cannot create ‘new money’ or make unsecured loans. Excess government borrowing creates investable assets that absorb excess credit. These are reasons why Japanese easy monetary- and fiscal policies since the early 1990s have not produced inflation.

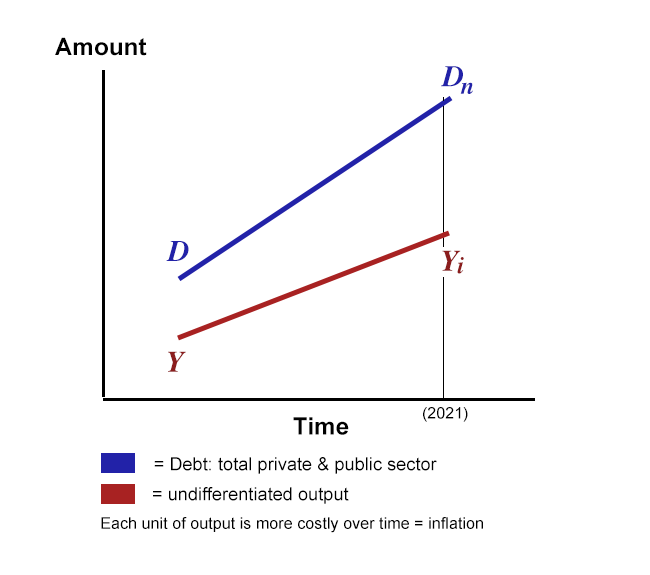

At the same time, there is an inflationary bias to debt-based economic systems because productivity of credit tends to run down with time. Each unit of output costs more:

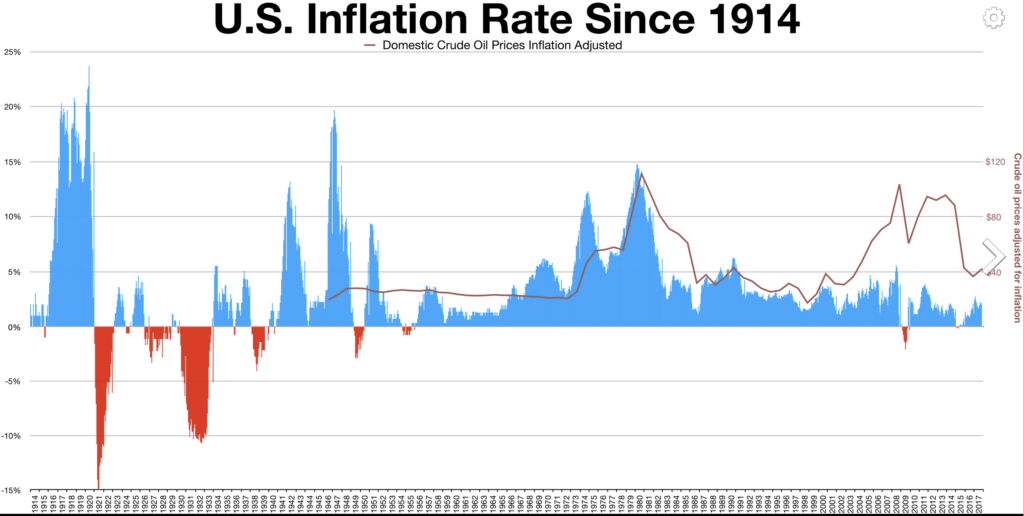

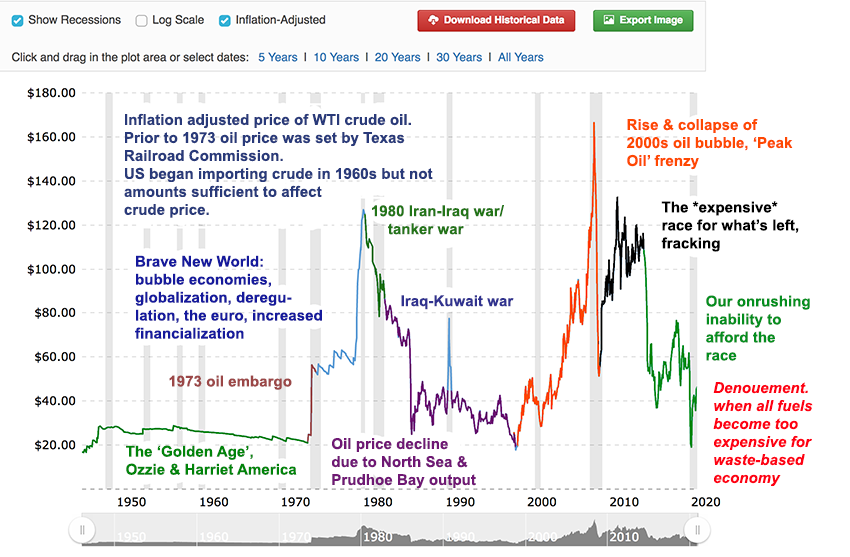

Since World War One there has been generalized inflation with higher rates after wars. The inflation of the 1970s was largely the footprints of the Yom Kippur- and Iran-Iraq wars pushing oil prices higher along with the costs of the failed US adventure in Vietnam. Current price increases reflect the surge of finance credit into speculative assets such as commodity futures contracts, houses, crypto and shares. Commodity speculation has knock on effects on consumer prices. When the prices to end users are too high the end users stop buying. Firms adjust their prices or else, with knock on effects from this as well. (From BLS data)

Image credit: Wikipedia. Inflation rates and inflation adjusted crude price

Deflation (the red areas on the chart) was an issue early on in the 20th century because of under-capitalized banks and an insufficient range of remunerative investments. There was only so much demand for railroads, hotels or steamships. Currently, impaired bank balance sheets and insufficient money capital and absence of remunerative investments- plus barely affordable energy prices means the risk for deflation is greater than inflation: low bond yields- and negative real interest rates suggest the same thing.

Inflation is self-limiting because rising fuel prices cause a chain reaction in credit. Rising fuel prices generally are accompanied by market volatility. This feeds on itself and does so remarkably quickly. The outcome is either recession or declining effective fuel demand and less inflation.

The force of events since 2000 is changing the narrative as limits are closing in on us.

TIME: And the stock market?

LARRY SUMMERS:

I’m also concerned about inflation in asset prices, where there’s increasing evidence of speculative froth, in particular markets like the SPAC [special purpose acquisition companies] market and like the recent events in cryptocurrency. What I fear is that we’re pouring water into that bathtub much too fast.

ECONOMIC UNDERTOW:

People blame the Fed for asset bubbles and they are responsible along with the US government for moral hazard. But finance needs no help or encouragement from the central bank or regulators to lend to itself. It only needs to know it will never be audited.

TIME: How does this play out? What is the negative scenario?

LARRY SUMMERS:

The more overweight you get, the more painful your diet has to be. Ultimately we will correct this. The more the correction is delayed, the greater the disruption and dislocation.

ECONOMIC UNDERTOW:

Negative scenario: the bubble pops and the under-capitalized banks fail as they did in 2008. Mirroring Larry, the bigger risk is loss of confidence, loss of credibility/creditworthiness generally. That will mean the end of the bailouts and our myriad zombie enterprises will be left to collapse on their own.

TIME: Who gets hurt?

LARRY SUMMERS:

It tends to be the case that sophisticated people are better able to configure their affairs to hedge themselves against inflation.

ECONOMIC UNDERTOW:

The little guys at the bottom of the food chain get hurt first, always. They lose their jobs, are evicted, wind up living on the street. Now it’s the middle class people. Disaster capitalism is eating these people up. Nothing really changes until the big shots are ruined like the 1920’s millionaires who lost everything in the Great Depression. Afterward came tighter bank regulation, Glass-Steagall, deposit insurance, the SEC, margin limits, jobs programs, Social Security, etc. All of it to protect the elites from themselves.

TIME: Any other concerns?

LARRY SUMMERS:

I think another important part of the calculus is that when governments lose control over money, people tend to lose confidence in them.

ECONOMIC UNDERTOW:

Peak Oil, water shortages, topsoil depletion, fishery- and forestry collapse, mass extinction. In finance: non-remunerative endeavors like driving a billion cars every day, unchecked military spending, absence of accountability; widespread criminal behavior, flirtation with neo-Nazis, speculation, excess leverage particularly ‘off-balance sheet’ within shadow banking, derivatives and manipulated markets. Denial: we have a number of interlocking problems centered on overpopulation and resource depletion: the biggest problem of all is the refusal to discuss these problems. What’s missing from this calculus is that left alone, these problems will solve themselves, which will be unpleasant.

TIME: Do you think there’s any aspect of this that the Administration is letting the economy run hot because it’s effectively a way of giving lower-paid workers a raise?

LARRY SUMMERS:

We all want the economy to be as hot as it sustainably can be. It is the last hired, first fired group that is going to be most sensitive to that. It is also that group that has the biggest stake in our avoiding an unnecessary recession caused by a period of overheating.

ECONOMIC UNDERTOW:

Larry Summers doesn’t know what ‘sustainable’ means. It has nothing to do with businesses free of external support but rather operating within ecological limits. By that measure there are no sustainable large firms anywhere in the world. What we have are pets, stuffed elephants we are fond of because of the sparkly detritus they excrete. The US economy is an interlocking collection of speculative bubbles inflated by excess credit. Bubbles pop, then banks fail due to bad loans and defective capital structures (insufficient capital, generally). Historically, wages in the aggregate never keep up with prices. Inflation is the means to destroy workers bargaining power.

TIME: Why do you think employers are having a difficult time filling jobs right now?

LARRY SUMMERS:

In many cases it’s because they [workers] can earn more money while incurring less cost and less effort collecting unemployment insurance. In some cases it’s because of their responsibilities to their families. And because of what’s happened in markets there’s clearly been a lot of people who retired early during COVID.

ECONOMIC UNDERTOW:

At this moment, workers have leverage. “If you want us,” they say, “pay us.” Benefits are not likely the issue, the underground economy in the US is broad and deep, the barriers to entry are small. The eviction moratorium also means less financial pressures. Tenants can pay down debt or look for better cars they can live in after they are kicked out of their apartments.

TIME: Finance Ministers from the Group of Seven nations have been generally receptive to President Biden’s call for a global minimum tax on corporate profits. Do you think level-setting international tax rates is a good idea?

LARRY SUMMERS:

It’s exactly the right thing to do. The U.S. was making a fundamental choice wrong and now it’s making it right.

ECONOMIC UNDERTOW:

If the US government was serious about revenue it would levy against finance transactions, it would tax finance to the point where it could be drowned in a bathtub. Going further, the US could cease being the provider of dollar credit for every wannabe Stalin. Right now Wall Street directly and indirectly finances America’s adversaries: Russia, China, Iran, North Korea via China, Turkey, dictators and gangs in Central America and Mexico. Why? The US gets cheap junk from China, dope from Mexico and petroleum to burn up for nothing. The real beneficiaries aside from the borrower countries are the banks which gain a seigniorage premium. The US could declare every dollar held outside the US is worthless, requiring repatriation. This would be disruptive, it would be a default, but one that would benefit the United States directly like Roosevelt taking specie out of circulation in 1933. It would also reduce the hazard- and potential costs of military confrontations. If Putin wants to take over the world let him do it on his own dime.

TIME: How likely do you think that is to be successful? Every country has the same issues, right?

LARRY SUMMERS:

I would be very surprised and disappointed if there is not a meaningful improvement in international tax cooperation that derives significant revenue.

ECONOMIC UNDERTOW:

Corporations will cheat. Think flags of convenience in the maritime industry. There are a lot of shithole countries out there that would like to headquarter some Fortune 500 companies. Why not tackle the banking octopus that funnels elites’ holdings to tax havens? Why not deal with corporations directly? “If you want to do business in this country you have to be significantly- and operationally present and tax liable in this country. Otherwise, fuck off!” Corporate charters is another topic that deserves its own rant. On one hand the management is watching the house burn down on the other the same management is adjusting the air conditioning vents so it doesn’t feel too hot.

TIME: We are in the longest bull market in history, approaching 10 years. You mentioned speculative froth: Where are you putting your money these days?

LARRY SUMMERS:

I think it’s a fool’s game to try to outguess which way markets move.

ECONOMIC UNDERTOW:

I agree with Larry, the whole thing is a fool’s game.

TIME: And cryptocurrencies?

LARRY SUMMERS:

Look, the blockchain is a fundamentally important innovation that will be part of our economy for a long time to come. It will be to the 21st century what alternating current was to the 20th century, something that makes all kinds of things possible.

ECONOMIC UNDERTOW:

Crypto is interesting. The possibility is for an asset that is difficult or impossible to steal which would be a legitimate economic advance. A problem is dependency on computers, complex networking systems and grid electricity. It’s an asset class created to absorb excess credit in a highly speculative environment. This is another problem because currency is a liability to the holder, ‘money’ having no worth until it’s spent (exchanged for some good or service). Likewise, currency must be worth less than what it’s exchanged for, otherwise it’s held rather than spent. This is a problem underlying central bank crypto because they are not tasked with creating assets. It might be useful to have a conversation with Nathan Tankus or Frances Coppola about central bank digital assets that might/would alter central bank balance sheets in potentially useful ways. Right now the crypto business is too new to know best practices, it needs sorting out.

TIME: What are you hearing from CEOs regarding their biggest concerns about the economy?

LARRY SUMMERS:

People feel the economy is extremely strong right now, but they worry about whether they can fill the orders they’re getting. They worry how long the orders are going to come. So I think the feeling is, It’s great while it lasts.

ECONOMIC UNDERTOW:

I’m lucky, CEOs don’t talk to me. If one was to call I’d tell him to quit before he does any more damage and to donate his wealth to charity. We have the best Potemkin economy dirty money under the table can buy. The question is not how long it will last but how long anyone wants it to.

Source link