Wh

Firstly you might ask it from the point of view of when is a good time to buy precious metals (gold and silver) in general.

This in turn could depend on fundamental reasons for buying gold and silver. Such as how the economy is doing, the risk of financial panics or currency devaluations [or in 2022 the risk of loss of value via inflation].

But it could also depend on technical reasons or rather just purely timing when to buy gold or silver depending on the price.

However when to buy gold or silver might also mean when should you buy gold or buy silver instead. That is whether to choose to buy gold over silver or vice versa.

This article aims to cover all these questions below. It also refers you to other articles that go into more depth on a specific topic about when to buy silver and gold…

Factors to Consider in Deciding When to Buy Gold or Silver

What Are Your Goals?

Are you buying gold or silver to “make money” or as a means of wealth insurance (to protect existing wealth). We don’t see gold and silver as investments per se. But more as financial insurance to protect your existing wealth. But gold and silver are financial insurance with upside too: See: Presentation – Gold & Silver: Wealth Insurance with Upside >>

Your Finances and Budget

Obviously your existing wealth plays a part in when to buy gold or silver and how much. Many analysts recommend owning physical gold and silver anywhere from 3% to 30% of your net wealth, to offer diversification and smoothing of portfolio returns.

But it goes without saying you need some wealth first in order to diversify it! It makes no sense to go into debt in order to purchase gold or silver.

Understanding Global Events

Global events can impact the prices of gold and silver. So having an understanding of these can help with determining when to buy gold and silver. For example, we saw the price of both metals rise in 2020 as the COVID-19 panic played out.

Other global factors could include a global debt crisis or even war. Read more: How might war affect the gold and silver price? >>

Are Gold and Silver in a Bear Market or a Bull Market?

That is, are the prices of gold and silver trending up (bull market) or down (bear market) over the longer term? The prevailing trend may play a part in choosing exactly when to buy gold or silver. Hint: We’re definitely in a bull market currently for precious metals. Albeit in the corrective phase of a larger rising trend.

Why Buy Gold and Silver?

If you haven’t already it’s also worth considering the reasons to buy gold and silver. As these may also have an impact on your decision as to when to buy gold and silver.

Check out these three articles for the reasons to consider:

Why Buy Gold? Here’s 14 Reasons to Buy Gold Now

Why Buy Silver? Here’s 21 Reasons to Buy Silver Now

Using Technical Analysis to Determine When to Buy Gold and Silver

Once you’ve decided to buy gold and silver, the ideal time to actually purchase is “on the dip”. That is when the price has pulled back. Technical analysis can be helpful in doing this.

You may also want to get free access to our daily price alert email for gold and silver. Because in this email we have charts of gold and silver and our comments on them. That could also aid you in timing when to buy.

What is Technical Analysis?

Technical analysis is simply using charts and indicators with a view to determining where the price of a financial asset (such as gold or silver) may be heading. But based solely upon what the price has done in the past.

Read more here: Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Using Gold Seasonality to Determine the Best Month to Buy Gold and Silver

Another method to aid in determining when the best time is to buy gold and silver, is using past historical trends. That is looking at the months throughout the year when the gold and silver prices fall the most. That way you can purchase following these periods when the price has dipped.

See: Gold Is Seasonal: When Is the Best Month to Buy? This shows the months of March, April and June are often the best time to buy.

However the above article looks at gold prices in US dollars terms. As we explain here you should look at the price in your home currency when buying gold and silver: Why You Should Ignore the USD Gold Price When Buying in New Zealand

So for New Zealand gold and silver buyers this next article may be of more use: Does Gold Seasonality Affect the NZ Dollar Gold Price?

Why Buying This Year is Better Than Waiting Until Next Year

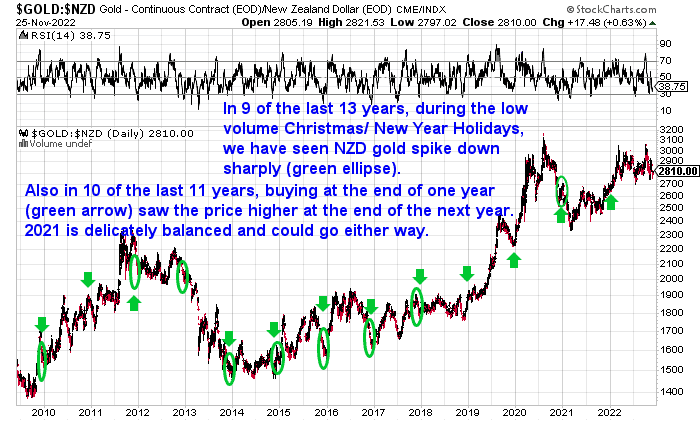

The chart of gold in NZ Dollars below, shows that you’ll also want to buy this year and not wait for next year.

As in 10 of the last 11 years buying towards the end of one year saw the gold price higher at the end of the following year (see the green arrows).

Note: We can also likely add this year to those 10 years where gold finishes the year higher than it ended the last year. That is assuming gold doesn’t tumble all the way back down below $2665 before the end of December – not impossible but probably not that likely given NZD gold is close to oversold currently.

Also keep an eye out for sharp drops in the price of gold and silver over the low volume Christmas and New Year holidays. In 9 of the last 13 years we have seen the gold price fall sharply around this time (see the green ellipses). Therefore also making it a good time to buy gold and silver near the end of the calendar year. Will 2022 prove to be the same?

Gold has already fallen sharply since October. So even if we don’t see a spike down over Christmas, December 2022 will likely have been a good time to buy a year from now.

So once you make the decision that now is a good time to buy gold and silver, the next question may also be when to buy gold or when to buy silver instead?

Some people believe silver could be worth more than gold one day. Therefore they choose to buy silver instead of gold. We look at this concept in detail here: Could Silver Be Worth More Than Gold?

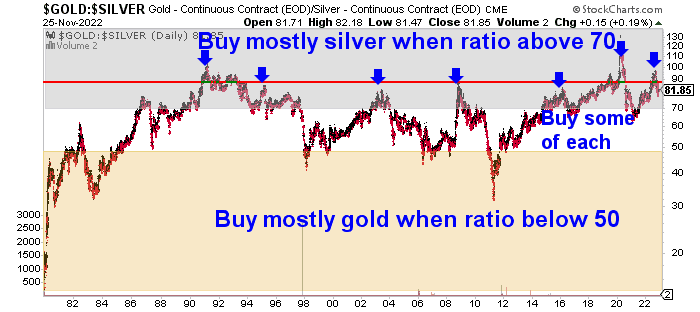

However there is a useful indicator to follow that can help identify better times to buy silver or gold.

The Gold Silver Ratio

What is the Gold Silver Ratio?

It is simply the price of an ounce of silver divided into the price of an ounce of gold. The resulting number shows how many ounces of silver it takes to buy an ounce of gold. Therefore this ratio can indicate when silver is under or over valued compared to gold. See this article for a full explanation of the gold to silver ratio: What is the Gold Silver Ratio?

Storage

For equivalent dollar amounts silver takes up vastly more space than gold. So you will need a bigger safe or vault to store silver than gold. That may be a factor in choosing between the two.

Mark Ups or Margins Over Spot Price

The mark up or margin over the spot price of silver is usually more than gold for most products. Read more: Why is it more expensive to buy silver in New Zealand?

So some people prefer gold over silver for that reason. But this may be made up for by the higher upside potential for silver as explained here: Could Silver Be Worth More Than Gold?

Note: For a full guide on choosing between gold and silver see: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver >>

Conclusion: When to Buy Gold and Silver?

Having said all of the above, perhaps the best answer to when to buy gold and silver is…

…Today!

Actually rather maybe it is: When you think you need it – rather than when you actually need it! That could well be today though.

A good time to buy is often when it seems gold and silver is needed least. Just like you don’t buy house insurance when you house catches fire, it’s best not to buy gold and silver in times of financial crisis and panic, but rather well before.

Determining when to buy gold and silver is perhaps not as crucial as the decision to actually buy.

So once you’ve made that decision, there is likely no point in delaying the actual purchase. There is a risk to trying to time your purchase and wait for a lower price. Something that may or may not arrive!

Gold and Silver Buying Strategy

A good strategy is dollar cost averaging. Which is simply buying at regular intervals. You can break up the initial total amount of gold and silver you wish to buy into a number of tranches. Then spread the purchases out over a series of weeks or even months.

History shows that while crashes, collapses, currency devaluations and financial crises don’t come around every year, they are still regular occurrences every 10 years or so.

So the aim should be to diversify your overall wealth, so that it is not severely impacted by economic panics and crashes – such as the 2008 financial crisis.

For more help with deciding when to buy, get access to our free Daily Price Alerts.

Or check out the gold and silver products available: Buy Gold or Buy Silver

Editors Note: This article was originally published 6 December 2017. It was last updated 28 November 2022 to include the latest charts and commentary in each section.

Source link