Estimated reading time: 12 minutes

We’ve spilled plenty of digital ink in these pages discussing the possibility, or maybe we should say the inevitability, of a change in the global monetary system. Perhaps in the form of a currency reset.

Here’s more on how that might play out.

If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

Does a Gold Revaluation to US$10,000 With All Major Countries Make Sense?

Last week we wrote how the various sanctions that the USA has taken out against the likes of Russia and Iran have likely only resulted in less use of the US dollar. These maligned nations are finding other ways to continue to trade with other countries. These measures from the US are also making other countries, who have not had sanctions taken out against them, also consider what the impacts on them might be if this were to happen.

Even prior to these sanctions there was already an ongoing erosion of the US dollar as the global reserve currency. In 2021 Russia announced it would eliminate the US dollar from its oil fund to reduce its vulnerability to Western sanctions. This affected about $119 billion in liquid assets in the fund, known as the National Wellbeing Fund, of which about a third was held in dollars.

Finance Minister Anton Siluanov noted that the dollar holdings were to be shifted to euros, yuan and gold.

Source.

The latest In Gold We Trust report notes that these moves out of the US dollar seem to have increased in velocity in recent years:

“De-dollarization is a reality: Adjusting for FX movements, USD has lost about 11% of its market share since 2016 and 2x that amount since 2008. USD’s share of global currency reserves dropped to only 58% in 2022 from a share of 73% in 2001.”

Source.

So some kind of currency reset is certainly looking more likely in the coming years.

For example, in 2019 we read an interesting piece by a Chinese think tank. Published in Chinese state media outlet the Global Times, this means it was approved by the Chinese government. It made the claim that the:

World needs to prepare for return to gold standard as Washington disrupts financial order

…What will “post-dollar era” currencies look like? What currency can replace the status of the dollar?

In fact, this will be a process of continuous trials. It would be hard for the Bretton Woods Conference to succeed in the current era, so the new super currency has to be selected through extensive experimentation.

First of all, digital currencies. Governments in various countries are making efforts in this regard, and market forces have also cultivated various digital currencies like Bitcoin and Libra. But they are far from being universally recognized and trusted by the global markets, and they are also far from winning the support of major economies.

Second, regional currencies including the euro. Politicians around the world actually missed many opportunities after World War II, because world politics seriously disrupted global financial order, but no one would admit it. The result is the weakening status of regional currencies, like the euro.

Then what’s left is the gold standard. After the collapse of the Bretton Woods System, the questioning of the gold standard has never stopped. The gold standard essentially represents a world financial order. When an old financial order faces collapse, it is necessary to create a new financial order. When the US decoupled the value of the dollar from gold, it actually committed to take on the responsibility of world finance, based on which a new financial order was formed. It is this financial order that has allowed the US to enjoy huge development dividends. Now, the US is unwilling to continue assuming and fulfilling such responsibilities for the current world financial order, and Trump has continuously intervened in the operation of the Fed and global financial market order. This development points to the necessity of seeking and building a new financial order, which is the fundamental basis for the re-emergence of the gold standard in the world financial market.

So the gold standard is an effort by the world market and financial system to balance the “Trumpian future.” It means that the US can take its own path and Americans will have the right to look after themselves, but other countries around the world will also have the right to make their own choices.

Source.

How Would a Global Currency Reset Affect Us Down Under?

Will we get to make our “own choices” as the Chinese think tank outlined?

In an interview with analyst Jim Rickards in the Daily Reckoning, Rickards was asked:

DR: Australia’s first gold rush was in New South Wales in 1851. Today Australia accounts for around two-thirds of gold mine reserves. Yet the Reserve Bank of Australia has a relatively tiny inventory of gold. Should the RBA be stockpiling more aggressively?

We’ll publish his answer below and then after that we’ll take a look at the same question from a New Zealand perspective. Including New Zealand’s gold mining production, in ground gold reserves and official gold reserves. Plus how these might impact New Zealand in a currency reset. So be sure to read all the way to the end.

Jim: When it comes to gold, gold in the ground and gold mining, there’s no question that Australia is a super power.

In terms of its gold reserves, they are large. In terms of its gold mining output, it’s one of the 10 largest producers in the world and has been for a long time. So Australia is a gold super power in that respect.

But that’s very different from official gold or government reserves…

When it comes to government reserves the RBA is actually pathetically small, relative to the size of the Australian economy.

Now, because Australia’s economy is significantly smaller than, say, China or the United States, of course it doesn’t need as much gold.

But if you just do a ratio of gold to GDP — because that gives you an ‘apples to apples’ comparison across the board — Australia has very little gold relative to the size of its economy, which is a significant size.

So you have this disparity between private gold, gold mining on one hand…and official gold on the other.

Official gold is what counts if there is a collapse in the international monetary system, which I do expect.This may also be of interest to youAnd by the way, that’s not an extreme statement. The international monetary system actually has collapsed three times in the past 100 years, and it does seem to happen every 30 to 40 years. It’s been over 40 years since the last one in the mid-1970s.

That doesn’t mean there’s going to be a collapse tomorrow, but it does mean that no one should be surprised if there is. That seems to be the shelf life approximately of the international monetary system.

And when the collapse comes you have to reform the system. Now I’m not saying it’ll be the end of the world and that we’re all going to be living in chaos, eating canned goods.

But the major powers in the world will sit down around the table as they did at Bretton Woods in 1944, and at the Plaza Hotel in 1985, and at the Genoa Conference in Italy in 1922.

They’ll sit down and they’ll reform the international monetary system.

The question is, how big is your seat at the table? How much voice do you have?

The more gold you have, the bigger the voice you’re going to have.

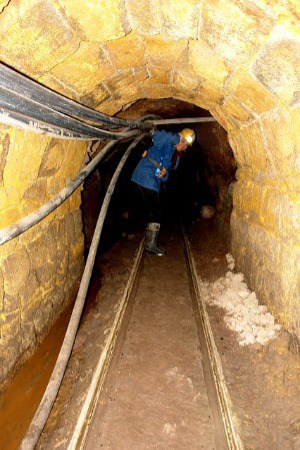

And just because there’s a lot of gold in the ground in Australia, that doesn’t mean it’s easy to dig up. It’s actually very costly. Australians know more about mining operations than most people around the world because it’s such a large part of the economy.

So it’s good that the gold’s there, but it’s not cheap or easy or quick to get it out of the ground.

The RBA should be increasing its gold reserves. Otherwise they’re not going to have a very big seat at the table when it does come the time to reform the system.

How Will New Zealand Fare in a Global Currency Reset?

Rickard’s makes the point that Australia has significant in ground gold reserves and also mining of gold. But very little central bank or government gold reserves in comparison to Australia’s GDP.

New Zealand has a much smaller GDP than Australia – 252 billion USD vs 1.707 trillion USD (2023 estimates). So the New Zealand GDP is only 15% of Australia.

How Does New Zealand Compare to Australia in Terms of Gold Mining?

Total gold production in New Zealand in 2021 was 5,815 kgs according to New Zealand Petroleum and Minerals. (Covid19 lockdowns and disruptions likely affected this as it was down from 8,217 kgs in 2019).

According to The Australasian Institute of Mining and Metallurgy, New Zealand contributed 2.5 per cent of the total gold produced in both countries in 2016. So not an insignificant amount.

It’s not so easy to find details of what the total New Zealand in ground reserves might be.

But taking the Proven and Probable Reserves from the 2 major gold mines in New Zealand – Macraes and Waihi – we get:

1.57 million ozs or a shade under 49,000 kgs of gold. Source.

There is likely much more than that too. As proven and probable reserves are only one particular measure of mineable gold.

So there is still plenty of gold in “them thar hills”!

But as Rickards points out, it’s not gold mining and in ground gold reserves that counts when a currency reset occurs…

How About New Zealand’s Official or Central Bank Gold Reserves?

We’ve looked at this topic before. See: Australia has 80 Tonnes of Gold, How Much Gold Does New Zealand Have?

While Australia may not have anywhere near enough gold according to Rickards, they do at least have some!

New Zealand on the other hand has 0 (as in Zero) tonnes of central bank or government gold reserves.

Just to match Australia’s “pathetically small” (as Rickards puts it) gold reserves on a GDP basis, New Zealand would need to have 12 tonnes of gold (15% of 80 tonnes).

But the RBNZ would need to really spend some cash in order to get New Zealand to similar gold reserves as some countries with similar sized GDP’s.

Countries with similar GDP to New Zealand and their gold reserves:

| GDP ($Billions) 2023 | Gold (Tonnes) March 2023 | |

| Peru | 268.235 | 34.68 |

| Iraq | 267.893 | 130 |

| Portugal | 267.721 | 383 |

| New Zealand | 251.969 | 0 |

| Kazakhstan | 245.695 | 332 |

| Greece | 239,300 | 114 |

| Qatar | 219.570 | 91.78 |

| Algeria | 206.007 | 174 |

| Hungary | 188.505 | 94.49 |

Even war torn Iraq and debt ravaged Greece have around 100 tonnes in gold reserves! (Iran also increased their reserves by over one third from 96.42 tonnes in 2021).

Why New Zealand Won’t Have Any Say in a Global Currency Reset

“He who holds the gold makes the rules.”

This saying was proven correct in past currency resets such as Bretton Woods in 1944, the Plaza Accord in 1985, and at the Genoa Conference in Italy in 1922.

While central planners have done their best to disparage gold, for some “strange” reason gold is still held as a major reserve asset by all major economies.

Given New Zealand holds no gold reserves at all anymore, in a currency reset we will have no say at all. New Zealand will simply have to go along with whatever is decided.

Furthermore it’s likely that the New Zealand Dollar would take a decent hit and be significantly depreciated in a currency reset due to this lack of gold reserves.

See here for how the RBNZ has likely already taken a hit to its foreign currency reserves: Why NZ should turn its foreign currency reserves into gold.

What Should You Do About New Zealand’s Lack of Gold Reserves?

So what should you do about the lack of national gold reserves?

Maybe start a petition requesting the government require the Reserve Bank to hold a certain percentage of its foreign currency reserves in gold?

No. We’d say that is likely a complete waste of your time and energy. Why?

Because back in 2012 a reader forwarded us an email from the RBNZ that said:

Dear Jake

Thank you for your question and apologies for the delay in responding.

The Reserve Bank of New Zealand has not held any gold reserves since 1991.

Our reserves management responsibilities are set out in the Reserve Bank Act of 1989 and our foreign reserve targets are specified by the Minister of Finance. The Reserve Bank is not, at this stage, planning to include gold in our foreign reserve portfolio. The Reserve Bank’s position is that gold does not meet our liquidity requirements.

Kind regards

Raewyn Peters

Knowledge Adviser | Reserve Bank of New Zealand

2 The Terrace, Wellington 6011 | P O Box 2498, Wellington 6140

T. +64 4 472 2029 | F. +64 4 471 3722

www.rbnz.govt.nz

Interesting that gold does not meet the RBNZ’s “liquidity requirements”. Even though gold can be sold at a moments notice and turned into cash. So the odds of a turn around from the Reserve Bank on buying gold looks slim indeed.

Get Your Own Reserves

We don’t know what the future will hold. We don’t know what the monetary system will look like, but odds are that in the next decade it will have undergone some serious change. A currency reset looks inevitable. Just the timing of it remains the unanswered question.

There are a lot of technological changes going on currently but gold (and silver):

- is the only currency that has stood the test of time for Millenia, and

- will likely still be around and of value (and likely more valuable than today) in 10 years.

So it seems like a good idea to have your own gold reserves. Read more: Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

Head over to our online gold and silver shop to see what options are available or get in touch if you have any questions.

Maybe also consider some silver as well as gold? See: What Use Will Silver Coins be in New Zealand in a Currency Collapse?

To learn more about the role gold may play in the global monetary system check out this article: If/When the US Dollar Collapses, What Will Gold be Priced in?

Editors Note: Originally published 10 October 2017. Last updated 6 June 2023 to include latest numbers for: GDP, New Zealand’s gold mining production, in ground gold reserves and official gold reserves and GDP of all countries. Plus news items about the In Gold We Trust report.

Source link